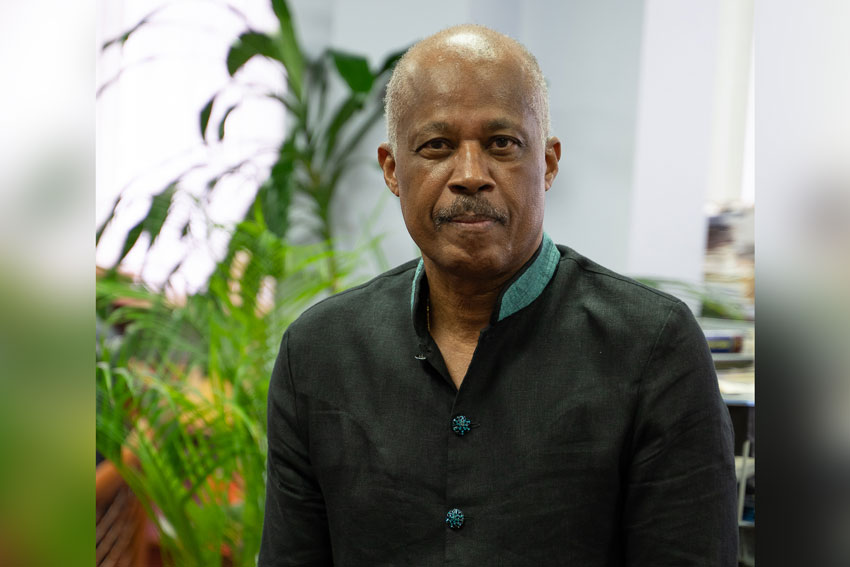

Prime Minister Gaston Browne says “there appears to be miscommunication” between the Trinidad-based Republic Financial Holdings Limited (RFH) and Scotiabank regarding the RHF’s interest in pursuing the purchase of the Antigua holdings of Bank of Nova Scotia (BNS).

Browne responding to an August 19, letter sent to him by Brendan G.J. King, Senior Vice-President International Banking of the Bank of Nova Scotia in Canada, reiterated his administration’s position that “our policy was that any sale should be made to an appropriate vehicle comprising substantial local ownership”.

“In good faith, my Government opened the opportunity for RHF to join a local consortium in purchasing the Antigua holdings of BNS. However, despite my Government’s participation in earnest and open discussions with RHF, by letter dated July 31st, 2019, Mr. Nigel Baptiste, President & CEO of RHF, informed my Government as follows: “… we regret to advise that we have decided to no longer pursue the negotiations re: the sale of any portion of the Antigua Branch. We advised BNS of our decision earlier today and will proceed to close on the other branches and banks”.

Browne said that his administration had taken “RHF at its written word” and had since indicated to King in an August 9th letter that his administration “and a consortium of local banks continue to have an interest in the purchase of Scotiabank Antigua”.

“Negotiations for such purchase can begin immediately”. This remains our position,” Browne wrote.

But he said that ‘despite this clear and unambiguous history, in your letter of August 19th, 2019 you state that BNS will “continue to pursue a transaction with Republic Bank for the sale of our operations in Antigua and Barbuda..

“By adhering to this position, BNS displays a blatant disregard for the laws of Antigua and Barbuda and the role accorded to the Government for safeguarding the integrity and sustainability of the banking sector. A similar law exists in Canada and BNS is well aware that it could not sell its holdings in Canada without the expressed permission of the authorities of the Government of Canada.

“Therefore, my Government and – I daresay – the people of Antigua and Barbuda are astounded that BNS insists on ignoring a law in Antigua and Barbuda that it would not dismiss in Canada,” Br0wne wrote.

Last November, the RFH announced that it was seeking to acquire Scotiabank operations in several Caribbean countries.

Antigua and Barbuda and Guyana had initially expressed reservations about the proposed acquisition, with St. John’s indicating that it would not be issuing a vesting order to facilitate the move.

The RFH statement said that the banks being acquired are located in Guyana, St. Maarten, Anguilla, Antigua and Barbuda, Dominica, Grenada, St. Kitts and Nevis, St. Lucia, and St. Vincent and the Grenadines.

It said that the purchase price is US$123 million, which represents US$25 million consideration for total shareholding of Scotiabank Anguilla Limited; and a premium of US$98 million over net asset value for operations in the remaining eight countries.

But Prime Minister Browne told the Caribbean Media Corporation (CMC) in July that he believes the region should consider getting together and purchase Scotiabank operations in the region.

“I thought that was an excellent opportunity for the OECS counties in particular to come together and purchase the branches,” he said noting that it would have required at least 98 million US dollars for the nine branches “with perhaps about three billion UIS dollars in assets

“I thought that was an excellent opportunity for the region which would have helped us to have one major bank that would have branches in the diaspora to provide banking services to Caribbean people in the diaspora,” Browne said.

In his letter to the Scotia Bank executive in Canada, Prime Minister Browne said that his government “takes careful note” of the final statement of his August 19 letter that ““if we (BNS) are unable to consummate the sale to Republic Bank, we will need to re-examine all of our options, including the closure of our operations in Antigua and Barbuda”.

Browne said he wanted to take the opportunity to “express its profound disappointment and amazement that, after more than sixty years of operations in Antigua and Barbuda in which BNS has repatriated large profits earned on the backs of Antiguans and Barbudans, that BNS would so causally state its intention to close the Antigua holdings because it refuses to sell the operations to an Antiguan and Barbudan entity.

“After sixty years of profits to BNS shareholders and revenues to Canada, the Government and people of Antigua and Barbuda are entitled to feel aggrieved at such contemptuous treatment.”

Prime Minister Browne acknowledged that it is the “right of BNS to close its operations in Antigua and Barbuda, provided always that it fulfills every legal and financial obligation to the depositors with the Bank and to its employees.

“However, we consider it highly irresponsible that, as the spokesperson for BNS, you could so casually threaten to close the bank without acknowledging BNS’ fiduciary responsibilities and committing to fulfill them.

“Please be assured that my Government will insist on the most scrupulous attention to the interests of employees and depositors should BNS decide to close rather than to sell to Antiguans and Barbudans from whose transactions the Bank made its considerable profits.,” Browne wrote.